Lab-6-1

(34% of the course mark)

Final Project - Tax Calculator App

- In this take-home final exam, you will build a tax calculator app using HTML, CSS, and JavaScript. The tax calculator app should calculate and display both federal and provincial taxes based on the entered income.

Outcomes

-

This take home final exam covers the following concepts:

-

HTML structure and form elements.

-

CSS style declaration.

-

Event handling in JavaScript.

-

Basic arithmetic operations in JavaScript.

-

Basic usage of JavaScript data structures, functions and control flow.

-

JavaScript DOM manipulation to update the display.

-

Async JavaScript processing by consuming a REST endpoint.

-

Mark breakdown

-

HTML coding = 33%

-

CSS coding = 33%

-

JavaScript coding = 33%

-

Bonus Question = 1%

Tax Bracket App

-

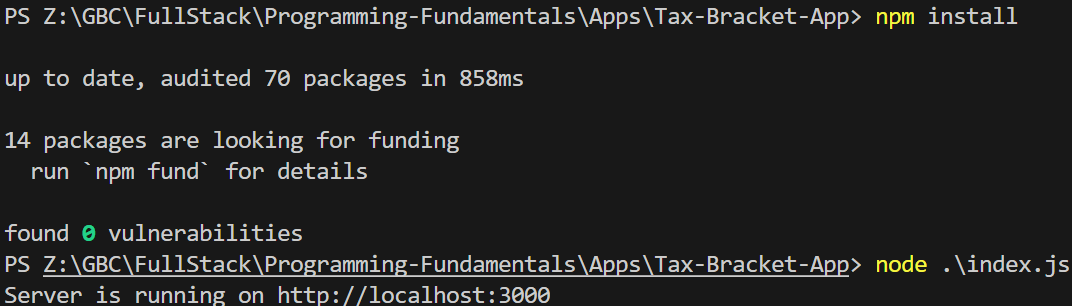

Download and extract the file Tax-Bracket-App.

-

Open Visual Studio Code and open the extracted folder: Tax-Bracket-App.

-

Open the terminal and type the following:

npm install

node index.js

Ensure that the node app is running before you continue.

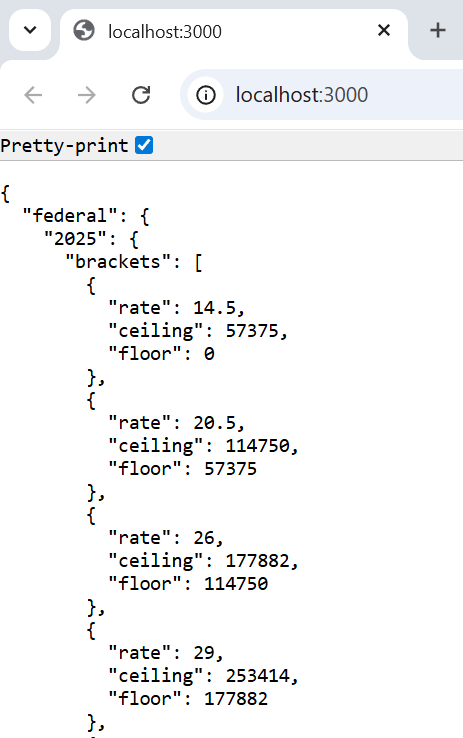

- Test the Tax-Bracket-App by navigating to: http://localhost:3000.

Ensure that you are receiving a valid response from the Tax-Bracket-App. You should see something similar to the example below:

Partial Browser output:

Complete JSON output:

{

"federal": {

"2025": {

"brackets": [

{ "rate": 14.5, "ceiling": 57375, "floor": 0 },

{ "rate": 20.5, "ceiling": 114750, "floor": 57375 },

{ "rate": 26, "ceiling": 177882, "floor": 114750 },

{ "rate": 29, "ceiling": 253414, "floor": 177882 },

{ "rate": 33, "ceiling": -1, "floor": 253414 }

]

}

},

"provincial": {

"Ontario": {

"2025": {

"brackets": [

{ "rate": 5.05, "ceiling": 52886, "floor": 0 },

{ "rate": 9.15, "ceiling": 105775, "floor": 52886 },

{ "rate": 11.16, "ceiling": 150000, "floor": 105775 },

{ "rate": 12.16, "ceiling": 220000, "floor": 150000 },

{ "rate": 13.16, "ceiling": -1, "floor": 220000 }

]

}

}

}

}

Tax Calculator Requirements

Here is a video demo of the Tax Calculator app.

-

The app shall display a loading message; a spinner may be used instead if preferred.

-

The app shall download the tax bracket JSON file by consuming the REST endpoint from the Tax Bracket app.

-

The app shall display an appropriate error message if it encounters an error or fails to download the tax bracket JSON file.

-

The app shall include an input box where the user can enter income in numeric format.

-

The app shall validate the entered income before performing the tax calculation. If the entered income or the tax calculations results in Infinity (∞), the input box and the HTML elements displaying the federal, provincial, and total tax shall be cleared and reset to their default values.

-

The app shall use the data from the tax bracket JSON file to determine the federal, provincial, and total tax amounts, ensuring calculation precision up to two decimal places.

-

The app shall perform the tax calculations as the user enters the income and display the federal, provincial, and total tax in their respective sections.

-

The app shall use proper semantic HTML structure.

-

The app shall use an external CSS file.

-

The app shall use an external JavaScript file.

Bonus Question

- Send an email to the instructor stating the best thing you have learned from taking this course.

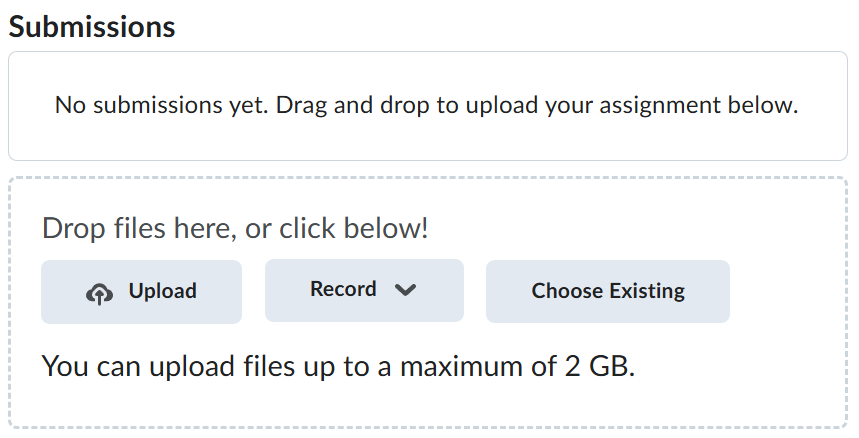

Submission

-

Create a folder named submit.

-

Copy all of the files used by the tax calculator app such as HTML, CSS, JS, and images to this folder.

-

Create a zip file of this folder.

-

Navigate back to where the lab was originally downloaded, there should be a Submissions section (see below) where the zip file can be uploaded.